Fiaxel Presale participants may receive a larger allocation of tokens compared to participants in later stages, allowing for a potentially more significant stake in the project.

Fiaxel Presale participants may receive a larger allocation of tokens compared to participants in later stages, allowing for a potentially more significant stake in the project.

As a leading force in the realm of decentralized finance (DeFi), Fiaxel stands at the forefront of innovation, empowering individuals globally to access transparent and inclusive financial opportunities. With a mission to revolutionize lending, credit scoring, and reporting, Fiaxel leverages cutting-edge blockchain technology to create a borderless financial ecosystem.

Driven by a commitment to financial inclusion, integrity, and innovation, Fiaxel envisions a future where anyone, regardless of their background or location, can participate in a decentralized economy. The platform's holistic approach integrates lending services, advanced credit evaluation, and real-time financial reporting, setting new standards for accessibility and security in the evolving landscape of decentralized finance.

Join us on the journey to redefine finance. Fiaxel - Empowering Tomorrow's Financial Landscape, Today.

Fiaxel Lending: Unlock decentralized liquidity with a peer-to-peer lending platform, offering fair terms, collateralized loans, and seamless access to financial opportunities on the blockchain.

Fiaxel pioneers a comprehensive DeFi platform, integrating lending, credit scoring, and reporting within a decentralized framework, providing users with a holistic financial experience.

Fiaxel is on a mission to democratize financial services, breaking down geographical and economic barriers to ensure global access to decentralized opportunities.

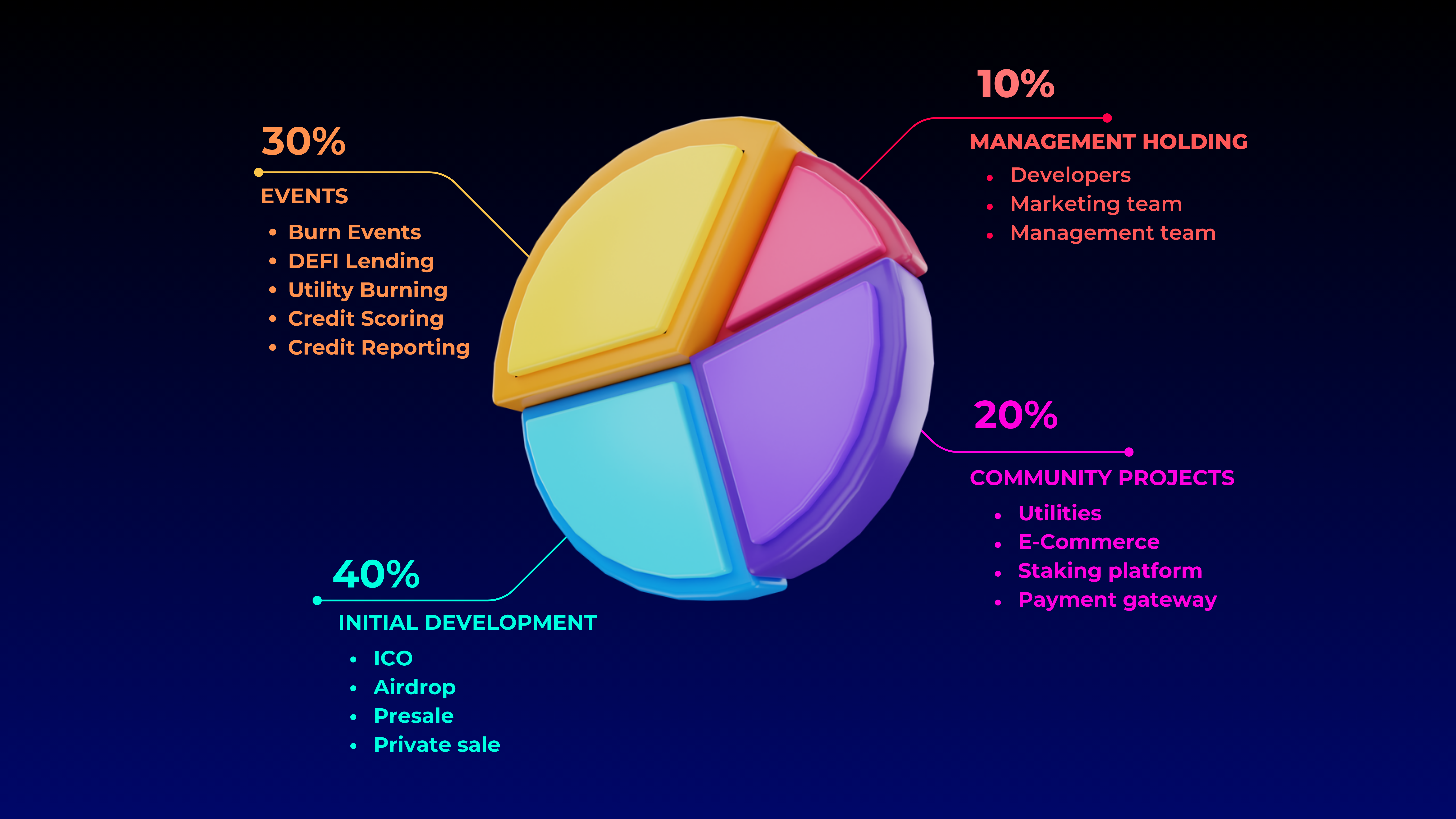

The Fiaxel Token (FXL) empowers users with governance rights, allowing them to actively participate in decision-making processes that shape the future of the platform.

Fiaxel employs advanced machine learning algorithms and decentralized data sources to revolutionize credit scoring, providing fair and inclusive assessments for users.

A roadmap serves as a strategic guide, outlining key milestones and objectives, providing clarity and direction for a project's development. It empowers teams and stakeholders with a vision, fostering alignment and efficient progress toward goals.

The Idea of Designing an Innovative and Hybrid Token.

Fiaxel Coin Created

Fiaxel Coin AIRDROP & Presale Starts

FXL Coin

Staking Rewards Starts

Fiaxel Coin Metaverse Platform Launch

Fiaxel Coin Listing in International Exchanges & Binance

Fiaxel Coin Metaverse Game Launch Event

Fiaxel Coin NFT and Metaverse live AMA Event

Fiaxel: Transforming finance with a decentralized ecosystem, offering lending, credit scoring, and reporting for global financial inclusion through innovative blockchain solutions.

PRESALE PRICE : $0.0012

NO OF DAYS : 30 DAYS

STARTING DATE : 1 Jul 2024

ENDING DATE : 30 Jul 2024

PRESALE PRICE : $0.005

NO OF DAYS : 20 DAYS

STARTING DATE : 1 Aug 2024

ENDING DATE : 20 Aug 2024

PRESALE PRICE : $0.012

NO OF DAYS : 20 DAYS

STARTING DATE : 21 Aug 2024

ENDING DATE : 10 Sep 2024

PRESALE PRICE : $0.05

NO OF DAYS : 20 DAYS

STARTING DATE : 11 Sep 2024

ENDING DATE : 30 Sep 2024

PRESALE PRICE :$0.08

NO OF DAYS : 20 DAYS

STARTING DATE : 1 Oct 2024

ENDING DATE : 20 Oct 2024

PRESALE PRICE : $0.1

NO OF DAYS : 40 DAYS

STARTING DATE : 21 Oct 2024

ENDING DATE : 30 Nov 2024

Decentralized Finance (DeFi) lending, often referred to simply as DeFi lending, is a financial service that allows individuals to lend and borrow assets, typically cryptocurrencies, in a decentralized, peer-to-peer manner. It operates on blockchain technology and smart contracts, eliminating the need for traditional intermediaries like banks.

Decentralized Finance (DeFi) lending works through blockchain technology and smart contracts to enable individuals to lend and borrow assets in a peer-to-peer, decentralized manner.

DeFi lending platforms offer several advantages, including transparency, accessibility, lower fees, and the ability to earn passive income or access loans without traditional financial intermediaries.

DeFi lending is typically peer-to-peer, meaning you do not rely on a centralized financial institution. There is no counterparty risk associated with a specific entity.

All deposits and withdraw are compatible in BNB Smart chain.

Users can Lend their assets and earn interest rates upto 5% daily.

24/7 customer support available.

Fiaxel is a decentralized finance (DeFi) platform that combines lending, credit scoring, and reporting services on the blockchain.

Fiaxel operates on a peer-to-peer lending model, utilizing blockchain technology for secure and transparent lending transactions. It incorporates credit scoring algorithms for fair assessments.

FXL is the native utility token of Fiaxel, used for Lending, governance, transaction fee discounts, staking, and other ecosystem-related activities.

The roadmap provides an overview of Fiaxel's planned development milestones and future enhancements. Refer to the official roadmap for the most current information.

Engage with the Fiaxel community through official social media channels, forums, and community events. Check the official website for links to community platforms.

Register on Fiaxel Community and the lending instructions will be provided.

Creating an account, deposite funds, and get your returns.

Interest rates varies from 1% to 5% daily.

Users can withdraw funds in 24/7.

There is no transaction fees however 10% withdrawal fees applicable.

Minimum investment is $30 & maximum investment in multiples of $20.

The Fiaxel presale is an early fundraising phase where contributors have the opportunity to purchase FXT tokens before they are available to the public.

Register on Fiaxel, and the participation instructions, are provided on the user dashboard and official communication channels.

Presale participants may enjoy benefits such as discounted token prices, early access to project updates, and potential bonuses or rewards.

Users can contribute as much as they want within the time period.

There are totally 6 phases in Fiaxel Presale.

There is no lockup period users can withdraw their FXL token any time to trust wallet.

The Fiaxel presale is conducted on a Binance smartchain network. Ensure you use a compatible wallet for participation

Yes, Fiaxel is a registered entity, and you can find details about our legal entity on our official website.

Fiaxel is registered in UK. We comply with the regulations and laws of this jurisdiction.

Users are protected by the terms outlined in our Terms of Service and Privacy Policy. These documents detail user rights, responsibilities, and the legal framework of using our platform

Users must comply with local regulations and be of legal age to use Fiaxel's services. Specific eligibility criteria are outlined in our Terms of Service.

Fiaxel is committed to regulatory compliance and engages legal experts to navigate and adhere to evolving blockchain and cryptocurrency regulations globally.

Fiaxel takes user data privacy seriously and follows strict protocols outlined in our Privacy Policy. Users have control over their data, and it is handled securely.

Fiaxel monitors regulatory changes closely and adapts its operations to comply with any alterations in legal requirements, ensuring a seamless user experience.

Yes, Fiaxel conducts KYC checks to verify user identities and ensure compliance with legal and regulatory standards.

Fiaxel has stringent Anti-Money Laundering (AML) measures in place to prevent illicit activities and fraud, as outlined in our compliance policies.

Users can report legal or compliance concerns through our official support channels. We take user feedback seriously and address concerns promptly